- TA Capital Research

- Posts

- TA Market Recap

TA Market Recap

Week ending 5/23/2025

Table of Contents

Market Snapshot

S&P 500 Heatmap Last Week

Market Highlights

Indices closed lower last week

All indices are bac to red YTD

RUT continues to underperform

Index | Last Week | YTD |

|---|---|---|

S&P 500 (SPX) | -2.61% | -1.34% |

Nasdaq 100 (NDX) | -2.39% | -0.46% |

Russell 2000 (RUT) | -3.47% | -8.33% |

Dow Jones Industrial Average (DJI) | -2.40% | -2.16% |

Best/Worst S&P 500 Equities Last Week

Best

Ticker | Last Week | YTD |

|---|---|---|

$GEV | +8.49% | +41.18% |

$DG | +8.38% | +33.72% |

$INTU | +7.44% | +14.58% |

$NEM | +7.09% | +44.14% |

$MRNA | +5.63% | -36.84% |

Worst

Ticker | Last Week | YTD |

|---|---|---|

$FICO | -23.05% | -14.90% |

$ENPH | -21.35% | -42.28% |

$DECK | -21.00% | -50.24% |

$AES | -18.18% | -22.38% |

$CPRT | -15.93% | -6.48% |

Sector Performance Last Week

*For a full breakdown of sector performance, our clients receive in-depth analysis within our weekly Sector Rotation Report

Technical Analysis Brief

Each week, we review the S&P 500 (in order to provide a consistent, technical narrative for the overall market), as well as a select equity and an asset from the broader market.

S&P 500: $SPX | daily

Closed out last week with some pullback — but price remains over some major support levels. The pullback on Thursday/Friday moved price lower to retest the previously broken $575-$576 pivot, as well as the 200 day MA. For now, this chart remains bullish on all timeframes. If we start to see price slip below the MAs below, then we will adjust as needed.

CrowdStrike Holdings, Inc: $CRWD | daily

This was one of our Premium Watchlist breakout alerts for clients last week. Even with the pullback within the major indices last week, this chart saw new ATHs on Friday. Trending over the rising MAs, and clearing downtrend resistance — this chart looks very good here.

Silver | daily

Really good look for this chart last week, breaking out of the consolidation we had been monitoring with our clients. We were able to catch a +35% move in June calls within $SLV on the initial breakout, but Silver looks like it may want continuation into the ~$35 long term resistance level above. For now, this chart remains bullish over the MAs below.

*For updated analysis on the financial markets, our clients receive in-depth analysis DAILY within our weekly Market Analysis Report

TA Capital Research Performance

We continue to help our clients successfully navigate this volatile market in 2025. Below are our model portfolios, and the YTD performance for each:

Our model portfolios continue to help our clients successfully navigate the market — outperforming the S&P 500 by ~14%.

In addition to our Model Portfolio and consistent Research Reports, we provide our clients with daily Premium Watchlists — as well as chart alerts when these setups breakout.

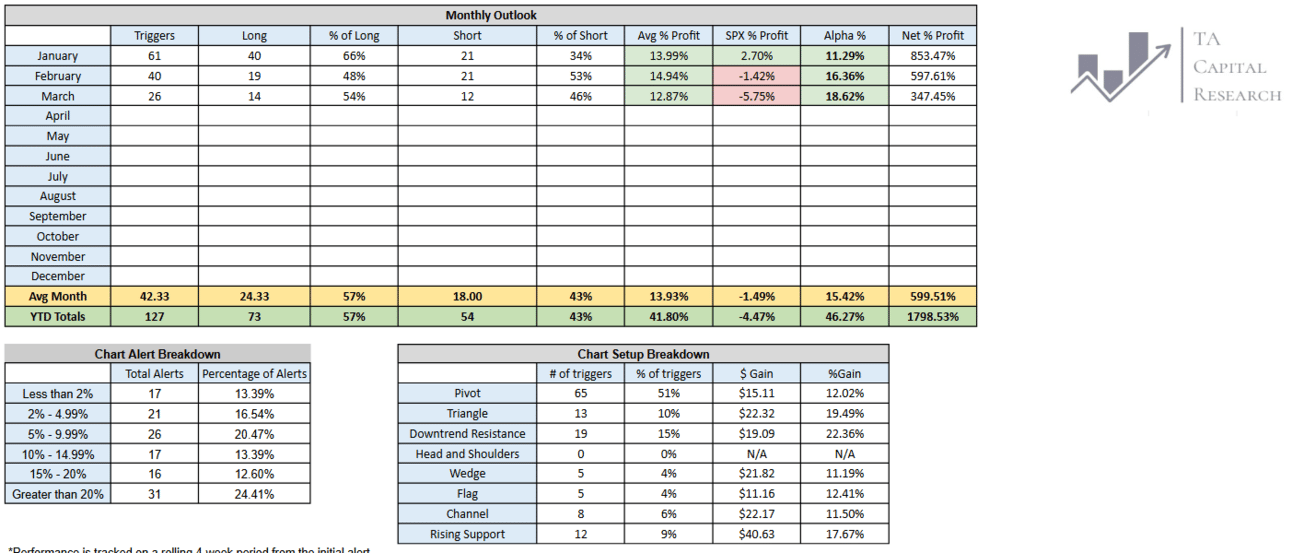

Attached is the YTD performance of our Premium Watchlist Chart Alerts through March 2025.

* Chart alerts are considered “live” for 4-weeks after the initial alert

Key Takeaways:

Outperforming the S&P 500 by an average of 15.42% per month

Net profit of ~1,800% on the year

70.87% of our alerts have provided a 5%+ move higher

50.39% of our alerts have provided a 10%+ move higher

If you are interested in trying TA Capital Research for free, we would love the opportunity to work with you! You can visit TACapitalResearch.com/Plans to start your free trial.

The information and analysis provided in this report are for informational purposes only and should not be construed as investment advice or a recommendation for any specific investment strategy, product, or service. Past performance is not indicative of future results, and all investments carry risks, including the potential loss of principal. TA Capital Research makes no representations or warranties regarding the accuracy or completeness of the information presented and does not assume any responsibility for any decisions made based on this report.

Reply