- TA Capital Research

- Posts

- Why TA Capital Research Outperforms — Nearly 3× the S&P 500 YTD

Why TA Capital Research Outperforms — Nearly 3× the S&P 500 YTD

Table of Contents

Why TA Capital Research

At TA Capital Research, we don’t just deliver market commentary — we deliver results you can follow in real time.

Here’s why investors turn to us:

📈 Model Portfolios That Outperform

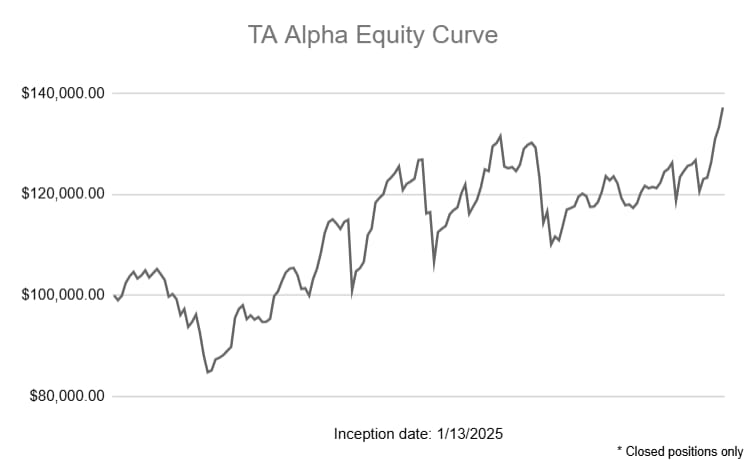

Our flagship portfolio, TA Alpha, is up nearly 3× the S&P 500 year-to-date — delivering sustained, measurable alpha through disciplined technical analysis and tactical allocation. You can view our model portfolios HERE.

🧠 Robust Research Suite

Our daily, weekly, and monthly reports give you the full market picture — from sector and global rotation insights, to macro and style/factor leadership trends — keeping you ahead of market moves before they happen. You can view our suite of research reports HERE.

⚡ TA Breakout Alerts

Our proprietary alerts are beating the S&P 500 by 12% per month — giving clients the ability to act in real time. You can view our TA Breakout Alerts performance HERE.

🔍 Bespoke Research

We tailor deep-dive analysis to your specific portfolio needs — whether it’s risk management, sector exposure, or macro positioning.

Why it matters:

We believe investing isn’t about chasing the market. It’s about being positioned ahead of it — with clarity, conviction, and confidence. That’s what TA Capital Research delivers.

TA Model Portfolio Performance Year-to-date

TA Alpha

A flexible, dynamic portfolio designed to capture short- to mid-term trends across a broad range of asset classes.

Objective:

Capital appreciation through adaptable allocations.

Strategy:

Target equities, ETFs, and other securities with strong growth potential.

Actively adjust positions based on market conditions, sector performance, and economic trends.

Maintain broad and flexible allocation across sectors and asset classes to maximize opportunity and manage risk.

TA Global

Provides global diversification by rotating into the strongest-performing international markets (ex-US).

Objective:

Maximize returns through targeted exposure to countries and regions with the highest relative strength versus global benchmarks.

Strategy:

Allocate across developed and emerging market ETFs.

Adjust positioning based on global market cycles and macro trends.

Concentrate in high-momentum regions while reducing exposure to lagging markets.

TA Sector

Captures market leadership by dynamically rotating among the strongest-performing sectors.

Objective:

Maximize returns by allocating to sectors demonstrating the highest relative strength.

Strategy:

Rotate dynamically among the 11 SPDR sectors.

Adjust allocations based on market cycles, economic trends, and performance.

Concentrate in high-momentum sectors while minimizing exposure to weaker sectors.

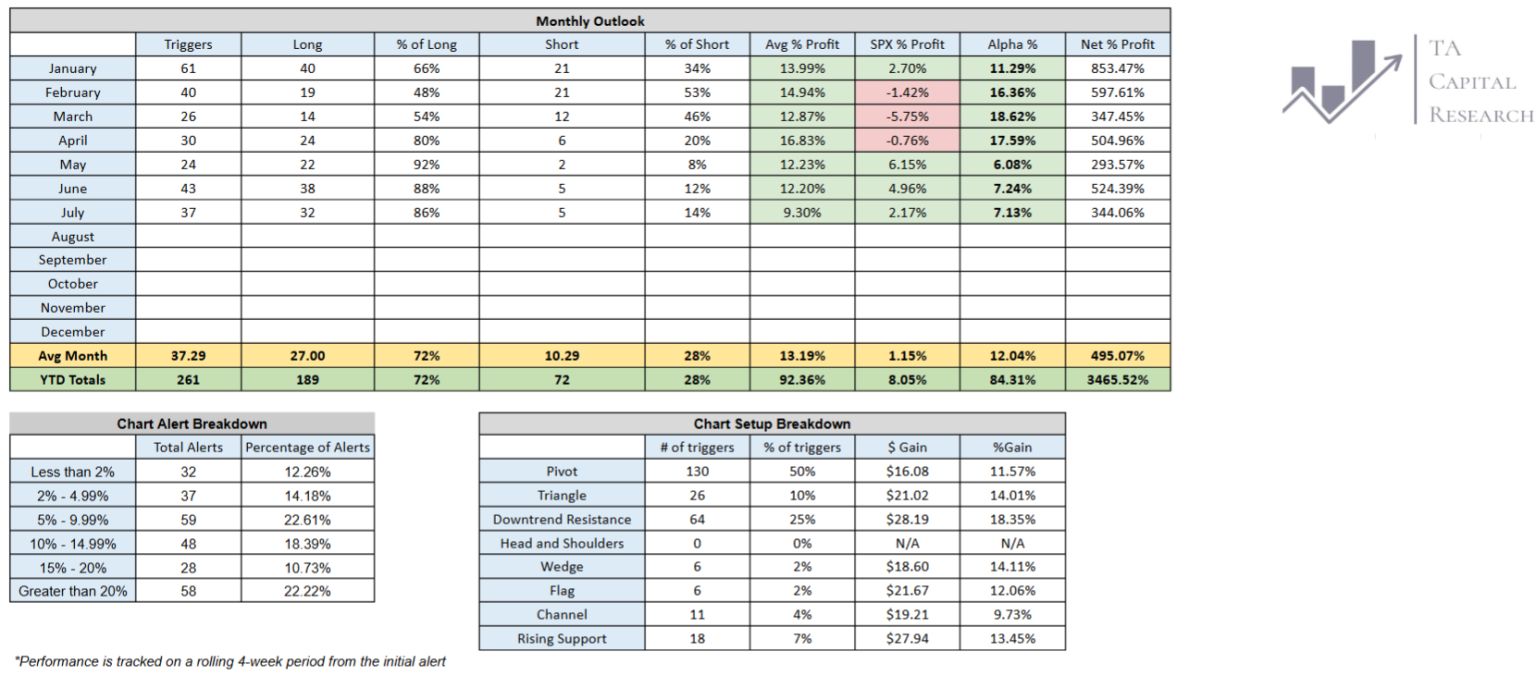

TA Breakout Alerts in 2025

Real-time alerts identifying high-probability market moves, giving clients a critical edge.

Key Takeaways:

Outperforming the S&P 500 by an average of ~12% per month.

Net profit of 3,465.52% year-to-date.

73.95% of alerts have delivered a 5%+ move higher.

51.34% of alerts have delivered a 10%+ move higher.

Free Trial

Don’t just follow the market — stay ahead of it. Explore TA Capital Research with a free trial HERE.

👉 Whether you seek high-growth opportunities or steady global exposure, our portfolios provide professional-grade strategies without AUM fees.

Reply